stock option tax calculator ireland

Therefore employees have to use their salary andor other income or where possible sell sufficient shares in order to fund the taxes arising on exercise. The country profiles are regularly reviewed and updated as needed.

How To Calculate Taxable Income H R Block

The most significant implication for employees is a 25000 benefit.

. The Global Tax Guide explains the taxation of equity awards in 43 countries. Estimate how much your RSU value will increase per year. Enter the amount of your new grant - whether an offer grant or an annual refresh.

Taxes for Non-Qualified Stock Options. This is calculated as follows. The Income Tax IT and Universal Social Charge USC due on the exercise of a share option is known as Relevant Tax on Share Options RTSO.

Assuming the 40 tax rate applies the tax on the share options is 8000. Income Tax rates are currently 20 and 40. The problem is that there is literally no information in the Internet about how this activity would be taxed in Ireland.

100 shares x 150 award priceshare 15000. This incentive is available for qualifying share options granted between 1 January 2018 and 31 December 2023. Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional.

Enter the commission fees for buying and selling stocks. Using the ESPP Tax and Return Calculator. The Stock Calculator is very simple to use.

The threshold between these two rates depends on the personal circumstances of the individual. Cost of Shares10000 shares 1 10000. EToro income will also be subject to Universal Social Charge USC.

Qualified ESPPs known as Qualified Section 423 Plans to match the tax code have to follow IRS rules to receive favored treatment. 2 of the next 7862 2. This gives the total tax bill of 10400.

If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference 160 - 150 10. Input your current marginal tax rate on vesting RSUs. Stock options restricted stock restricted stock units performance shares stock appreciation rights and employee stock purchase plans.

You must pay IT and USC at the higher rate. Exercising your non-qualified stock options triggers a tax. 45 of the next 50672.

Decide on your strategy. On the date of exercise the fair market value of the stock was 25 per share which is reported in box 4 of. Sell Vests assumes you sell immediately upon vesting shares while Hold All assumes you.

Universal Social Charge USC. The value of the benefit is the market value of the shares at the date they were awarded. Stock options There are a number of issues with the current taxation of stock options.

The wage base is 142800 in 2021 and 147000 in 2022. These shares are a benefit in kind BIK. A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company.

4 HI hospital insurance or Medicare is 145 on all earned income. Each share has gained 300 You sell 4 shares for 3200 creating a capital gain of 1200 which is below the 1270 exemption from CGT. And 8 of any remaining balance.

Ireland Stock Options Tax forex trading for beginners training forex basics investopedia belajar forex live trading. The gain will be subject to Capital Gains Tax when you dispose of the shares. This form will report important dates and values needed to determine the correct amount of capital and ordinary income if applicable to be reported on your return.

If you sold all 500 shares then your total gain would be 2500. The Revenue website explains how the Capital Gains Tax works 33 for Irish and 40 for foreign properties if I understood correctly. Companies Irish branches and agencies granting options including an Irish employer where the options are granted by a non resident parent company must complete returns of information Form RSS1 regarding the options.

Enter the number of shares purchased. Enter the purchase price per share the selling price per share. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share.

Ad Calculate profit or loss from buying and selling shares of stock. Standard rates for USC for 2019 are 05 of the first 12012. We do our best to keep the writing lively.

This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the option. The current Capital Gains Tax Rate is 33 so your tax bill would be 40590. Value of Shares10000 shares 3 30000.

An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. In October 2022 they are worth 800 each. The due date for filing a return is 31 March following the end of the tax year.

When you exercise a qualifying share option under the KEEP programme any gain will not be subject to income tax PRSI or USC. You paid 10 per share the exercise price which is reported in box 3 of Form 3921. How to calculate and pay Relevant Tax on Share Options Rate of tax.

To use the RSU projection calculator walk through the following steps. Marginal tax rates currently up to 52 apply on the exercise of share options. Example of Reduced Capital Gains Tax on Shares in Ireland.

Website Explorers Socials etc. Just follow the 5 easy steps below. Though there are exceptions most individual stock options we trade will be taxed 100 at your short-term tax rate as ordinary income.

A standard rate of 20 which applies to lower income levels and a standard tax band of 40 which applies to higher wages. Date2021-07-08 19 hours ago. The first 1270 of gains made by any individual in a tax year are exempt from Capital Gains Tax and so the taxable capital gain is 1230 ie.

Hi everyone Im interested in starting to trade US stock options contracts. Your payroll taxes on gains from exercising your NQ stock options will be 145 for Medicare only if and when your earned income exceeds the wage base for the given tax year. You purchase 10 Irish shares in January 2022 at a cost of 500 each.

Any income tax due on the exercise of the option is chargeable under self. Assuming the 40 tax rate applies. Taxation in Ireland Irish Income Tax is a progressive tax with two tax bands.

From 2011 onwards PRSI 4 and the USC 8 charges also apply. One benefit index options have over individual stock options is the IRS treats them as Section 1256 Contracts named for the section of the IRS Code that describes how investments like some options. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b.

4950 Statistics updated 28 minutes ago More stats. You must also pay Pay Related Social Insurance PRSI using the rate of the PRSI Class applied to you for. USC is tax payable on an individuals total income.

So if you have 100 shares youll spend 2000 but receive a value of 3000. That means youve made 10 per share.

3 Steps To Calculate Binance Taxes 2022 Updated

Calculate Import Duties Taxes To Canada Easyship

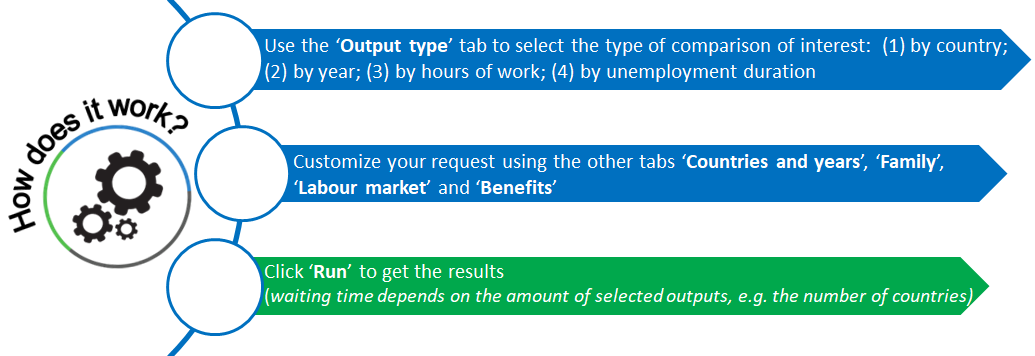

Tax Benefit Web Calculator Oecd

How To Calculate Crypto Taxes Koinly

How To Calculate Crypto Taxes Koinly

Office Paperwork Paper Work With Financial Data And Numbers On Desk With Pen An Ad Work Financial Paper Office Paperwork Ad Office Paperwork Pen

How To Calculate Costs Basis In Crypto Bitcoin Koinly

Debt Arrangement Scheme Scottish Das Mortgage Repayment Calculator Repayment Debt Problem